Gold on the Rise

Gold prices are rising primarily due to increasing inflation, a weakening U.S. dollar, and heightened global demand fueled by economic uncertainty.

Prices have been on a steady incline in 2024, catching the attention of both investors and everyday folks alike.

Want to know more about the value of your gold? Gold Rush Littleton is a dedicated buyer of precious metals and diamonds. We know gold and offer keen insights to our valued clients. Visit one of our many Colorado and Texas locations!

Inflation and Its Impact on Gold Prices

Inflation is a significant driver of gold prices.

When inflation rises, the value of currency typically falls, leading investors to seek out more stable stores of value.

Gold has a historical reputation as a hedge against inflation and often becomes the go-to choice.

Over the decades, we’ve repeatedly seen this pattern: higher inflation generally pushes gold prices up. To give you a clearer picture, let's look at how inflation rates and gold prices have moved together over the years.

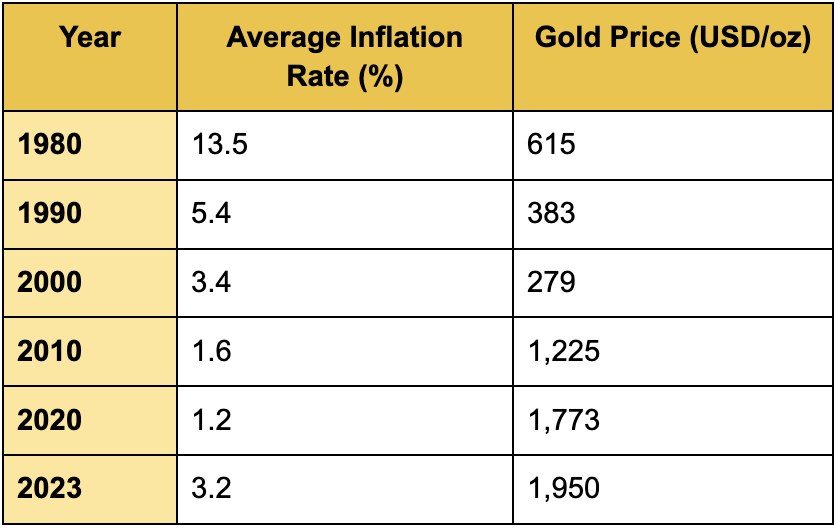

Historical Comparison of Inflation Rates and Gold Prices

The Influence of Currency Strength on Gold

Currency strength, particularly that of the U.S. dollar, has a profound impact on gold prices.

Gold prices often drop when the dollar is strong because gold becomes more expensive for investors holding other currencies.

On the flip side, a weaker dollar usually leads to higher gold prices as it becomes more affordable globally.

This relationship is key to understanding why gold prices fluctuate as currency values shift.

For example, during periods of a weakening dollar, like in 2020, gold saw a significant rise. The U.S. dollar lost some of its strength due to aggressive monetary policies, and in response, investors turned to gold as a safer asset.

This kind of inverse relationship is a cornerstone of gold pricing and an essential factor to consider when analyzing the market.

Geopolitical Tensions and Gold as a Safe Haven

Geopolitical tensions have a way of rattling markets. Uncertainties from conflict often cause gold to become the go-to asset for investors looking for safety.

Whenever conflicts arise or trade wars escalate, uncertainty pushes people to seek out reliable investments. Gold then sees its value increase as demand spikes.

Let’s take a look 5 geopolitical events in recent years that have significantly affected gold prices:

-

Russia-Ukraine Conflict (2022): This conflict sent shockwaves through global markets, leading to a sharp rise in gold prices as investors sought refuge from the volatility.

-

U.S.-China Trade War (2018-2019): Tensions between these two economic giants created uncertainty, driving investors toward gold as a protective measure.

-

Brexit (2016): The uncertainty surrounding the UK's decision to leave the EU caused a significant jump in gold prices, as markets reacted to the potential economic fallout.

-

Middle East Tensions (2019-2020): Various conflicts in the Middle East, including U.S.-Iran relations, fueled fears of wider unrest, pushing gold prices higher.

-

Global Pandemic (2020): The COVID-19 pandemic created unprecedented global economic instability, leading to a surge in gold prices as investors scrambled for a safe investment.

How Do Central Bank Policies Affect Gold Prices?

Central bank policies play a big role in shaping the trajectory of gold prices.

Interest rate decisions, in particular, have a direct impact.

Gold is an asset that does not yield interest. If the interest from other holdings increases, so does the opportunity cost of gold investments. On the other hand, when interest rates go down, gold becomes more attractive and gold prices rise.

In addition to interest rates, central banks also influence gold prices through their gold reserve policies.

When central banks, especially in emerging markets, increase their gold reserves, it signals confidence in gold as a store of value.

This buying activity can support and even boost gold prices.

What Drives Global Demand for Gold in Emerging Markets?

Emerging markets within India and China are key players in the global demand for gold.

Here are the key reasons why gold remains so popular in these markets:

-

Cultural Significance: In countries like India, gold is more than just an investment; it’s a cultural cornerstone.

-

Economic Growth: As incomes rise in emerging markets, so does the ability to purchase gold, both as jewelry and investment.

-

Investment Safety: In times of economic uncertainty, gold is seen as a stable and secure store of value.

-

Hedge Against Inflation: In countries with higher inflation rates, gold is often used as a hedge to protect against currency devaluation.

-

Government Policies: In some emerging markets, government policies actively encourage gold purchases, further driving demand.

Global Demand for Gold: Focus on Emerging Markets

Emerging markets have long been key drivers of global gold demand, with India and China leading the charge.

Demand from India

Gold is deeply ingrained in many cultures in India.

It’s a symbol of wealth and a trusted investment passed down through generations. With a growing middle class and rising incomes, the demand for gold continues to thrive. India’s investment in gold reflects both tradition and economic growth.

Demand from China

China views gold as both a strategic investment and a cultural asset.

The government encourages gold ownership for wealth preservation in uncertain times.

Economic policies, a large population, and concerns over market volatility make gold a popular and stable choice for Chinese investors.

Wrapping Up - Gold Experts at Gold Rush Littleton!

The rise in gold prices can be traced back to several key economic factors, including inflation, currency fluctuations, global demand, and geopolitical tensions. Each of these elements contributes to gold's enduring appeal as a safe and valuable asset.

One thing is for sure, Gold remains strong, supporting its price on the global market.

As gold prices continue to rise or plateau at their current attractive value, investors are looking for buyers. Dedicated gold buyers like the seasoned experts at Gold Rush have the knowledge and technology to place the most accurate value on your gold based on purity and weight, maximizing your investment. We treat our clients like family and always strive to earn your recommendations.

Isn’t it time you worked with a team that understands the true value of your investments? Visit Gold Rush today.